Debunking the Forbearance and Foreclosures Myths in 2021

Many homeowners had their lives turned topsy-turvy nearly a year ago with their economic stability, completely disrupted. In the beginning of the COVID pandemic, economic uncertainties were first and foremost in most American’s minds. The government very quickly responded to that angst, putting into place forbearance plans. They were available to homeowners who had experienced job loss and/or economic hardships, allowing them to remain in their homes, without making their monthly mortgage payments.

Some who signed up for the forbearance program, quickly rebounded and have since attempted to secure a mortgage for a new house and many to refinance their homes. Sadly, those who accepted forbearance are unable to refinance or secure mortgages.

The good news…

There is good news for those who were able to exit forbearance. Most homeowners must only make 3 consecutive payments AFTER exiting forbearance to be able to refinance.

**Note: I am not a lender so, please check with your lender to confirm that this applies to your mortgage.

Nearly three million American households are actively in a forbearance plan. While 1/3 of those in forbearance have continued to stay current on their mortgage payments, many have not. According to CoreLogic, 39% of those who accepted forbearance are 150+ days behind; fewer than 25% who are actively in the forbearance plan are 180+ days past due.

The better news…

When you compare today’s homeowners who are behind on their mortgage to 2006-2008, that number is really a drop in the bucket. The housing crisis during The Great Recession does not even remotely compare to today’s housing market.

Michael Sklarz, President at Collateral Analytics:

“We may very well see a meaningful increase in the number of homes listed for sale as these borrowers choose to sell at what is arguably an intermediate top in the market and downsize to more affordable homes rather than face foreclosure.”

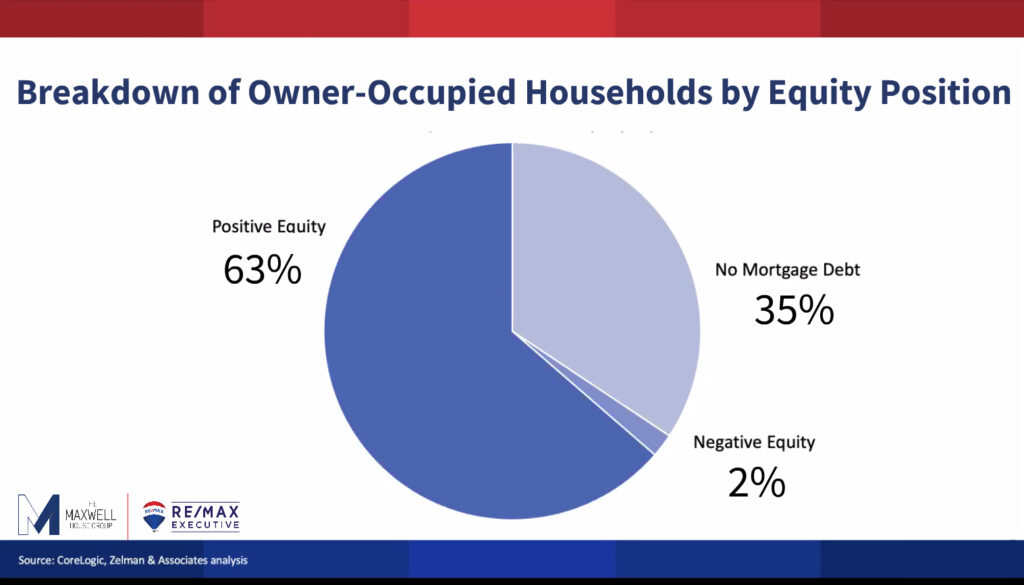

Delinquency alone is not enough to send a mortgage into foreclosure. Pundits who speculate that massive foreclosure is right around the corner, are not taking into consideration, the equity of the homeowners who are in forbearance. If push comes to shove, a large majority of those homeowners can sell their home to avoid foreclosure – and no, not short-sale it – sell it and cash out!

Many homeowners in distress have the option to tap into their equity to use until their economic strife improves. OR, instead of participating in the forbearance program their bank offers, they can simply refinance and reduce their mortgage payments. This can help them avoid having to accept forbearance and thus, having that impact further/future financial challenges.

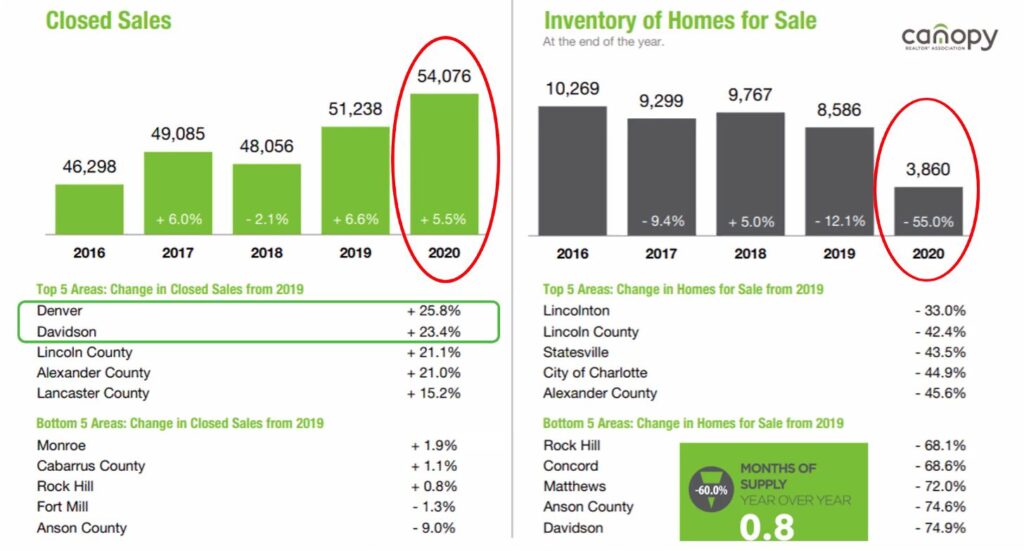

According to Realtor.com,“Nationally, the number of homes for sale was down 39.6%, (449,000 fewer homes for sale than last December).”

With the unprecedented lack of inventory on the market, the national market can easily absorb 500,000 homes this year, without home values depreciating. In the Charlotte Metro region alone, our inventory is down 55% – over 50,000 homes can easily be absorbed in our market.

Americans have suffered economic hardships in their lives – both personally and in business. The overall residential real estate market however, has overwhelmingly weathered the 2020 pandemic storm and will continue to do so in 2021.

© Debe Maxwell | The Maxwell House Group | RE/MAX Executive | CharlotteBroker@icloud.com | Debunking the Forbearance and Foreclosures Myths in 2021